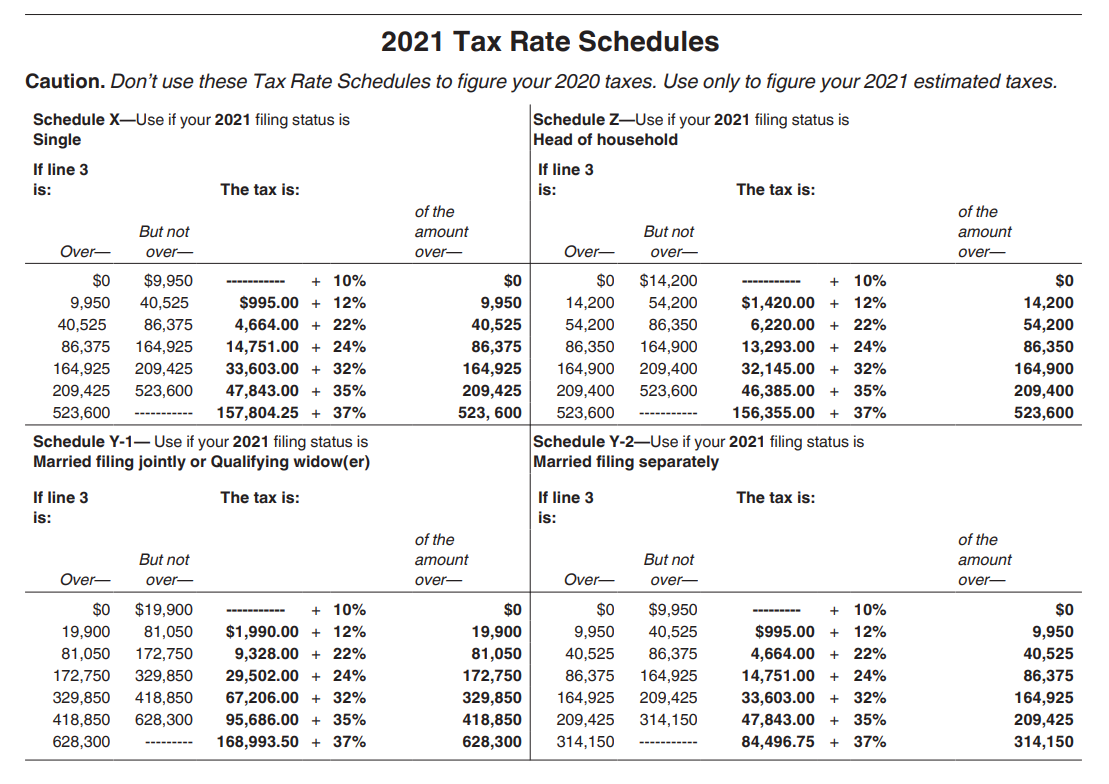

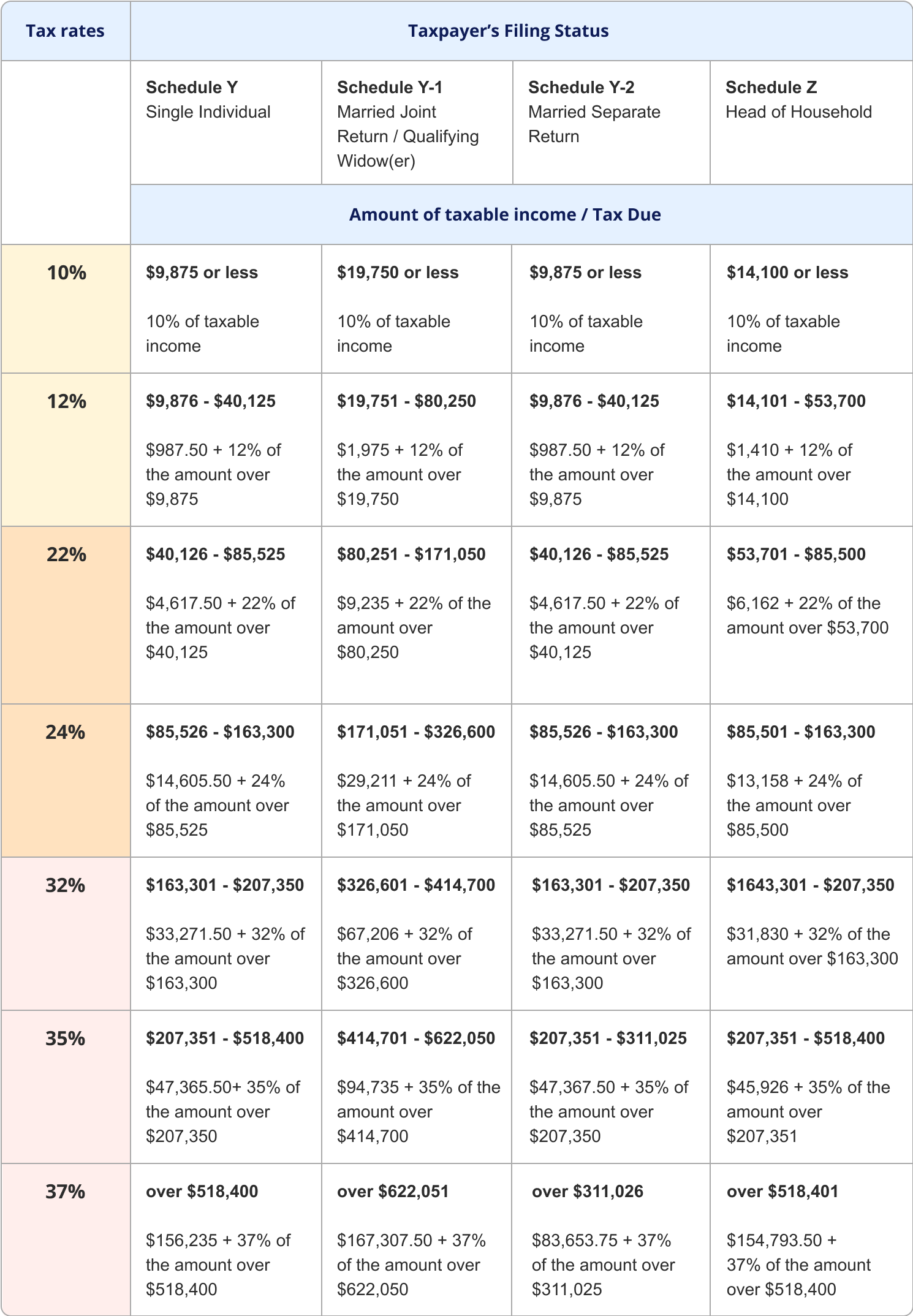

2025 Income Tax Rate Schedule. Here you will find federal income tax rates and brackets for tax years 2025, 2026, and 2027. There are seven (7) tax rates in 2025.

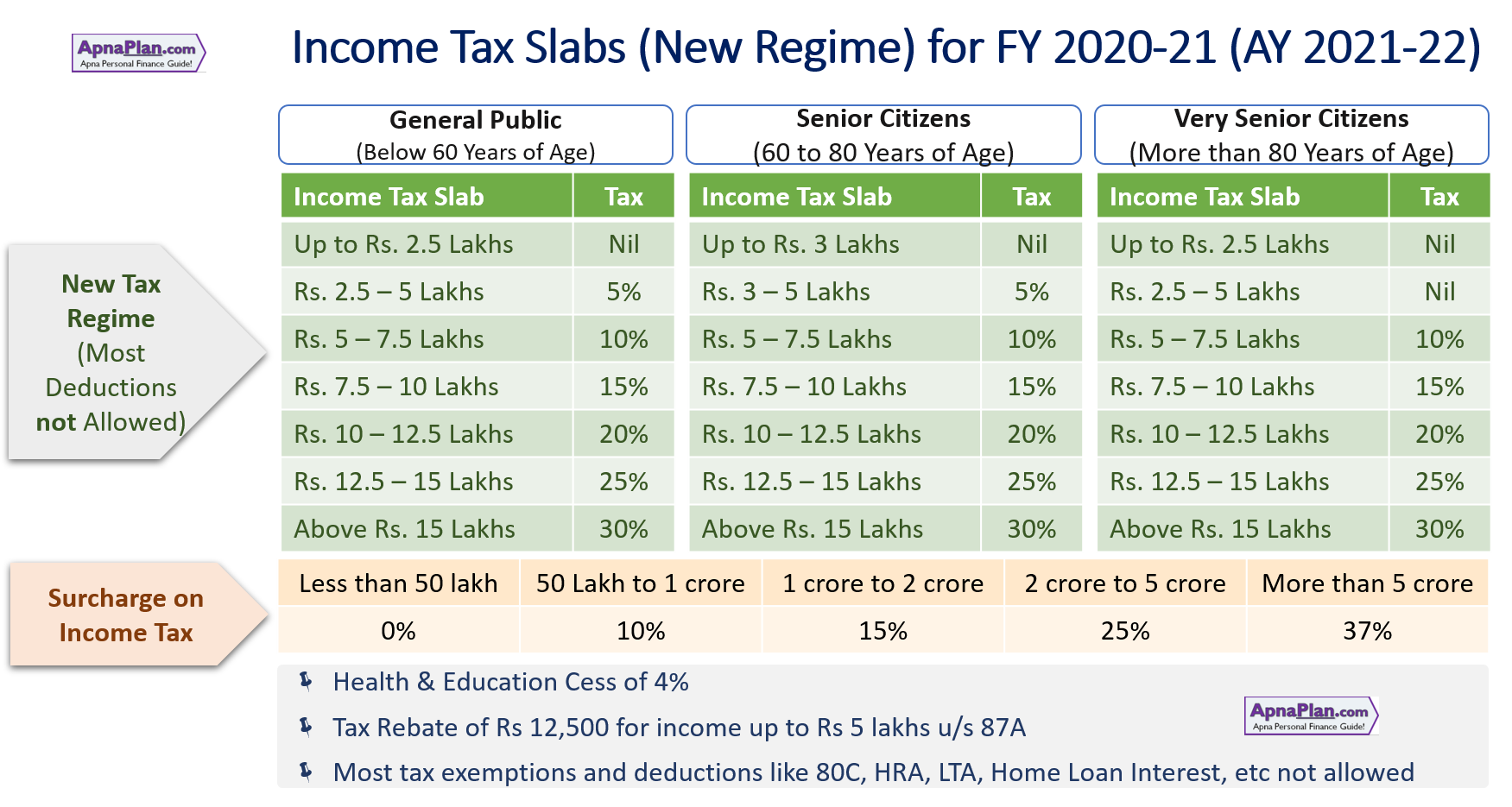

10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. The tax rates applicable to different categories of taxpayers, such as individuals, hufs, aops, bois,.

2025 Tax Brackets And Deductions For Seniors Maria Scott, Find the 2025 (for money you earn in 2025).

Changes To Federal Tax 2025 John Morris, Top 10 income tax changes from 2025 to look out for while filing itr in 2025 step 3:

2025 Tax Calculator For Senior Citizens Online Datha Nadine, Click the link to go to the income and tax calculator page.

IRS Announces Higher Tax Brackets For 2025, With a growing buzz around income tax announcements in the union budget 2025, there are chances that the government may introduce two important proposals that could.

California Tax Brackets 2025 2025 And 2025 Cheri Deerdre, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Calculate Schedule C Tax, Top 10 income tax changes from 2025 to look out for while filing itr in 2025 step 3:

What is IRS Form 1040ES? (Guide to Estimated Tax) Bench, From $14,539 to $16,129 for taxpayers with net income (line 23600) of $177,882 or less.

Tax rates for the 2025 year of assessment Just One Lap, The federal income tax has seven tax rates in 2025:

Tax season 2025 new tax rates, brackets, and the most important, The financial year for tax purposes for individuals starts on 1st july and ends.

Shifting Retirement Assets From TaxDeferred To TaxNow By 2026, Understand the exemption limits, tax slabs, surcharges, and eligibility for.

Cleaning Services Agency WordPress Theme By Classic Templates